Doomerism on the crypto Twitter timeline has been more rampant than usual. Price leads sentiment, so it’s somewhat understandable that people are feeling shaky about this industry and its use cases. But if we take a step back, much of the FUD isn’t so warranted — and it’s important to see how far we’ve actually come. After all, good things take time.

“But crypto has no use cases!!!”

There are use cases, you probably just aren’t paying attention to them. Many people expect progress to look a certain way, perfectly 1) in line with exactly what they expect or 2) parallel to how other industries have developed over time. For every industry, progress looks different — especially when an entirely new asset class is created from scratch. Within our own bubble, it’s easy to get cynical about what feels like industry stagnation. This isn’t true though, and below we’ll attempt to provide a whitepill on the state of crypto today, and how it’s only getting better.

Crypto already has PMF, if you know where to look

To zoom out, over 66% of crypto users live in the developing world, and lower middle income countries have continued to show sustained demand (India, China, Brazil, and Vietnam lead the way in terms of crypto adoption as of March 2024). The United States is up there too, but Americans don’t necessarily need to use crypto to avoid inflation and get access to a stable currency other than their country’s native one. On the flipside, for developing countries, crypto is a necessity now: it’s a mechanism to protect them from their own (often broken) government and financial system. In Latin America, for instance, it’s very common for people to get their paycheck and “immediately put it into USDT or USDC.” And more than a third of Latin Americans have made an everyday purchase using stablecoins, signaling that companies are beginning to accept crypto, too. Globally, USDT on Tron is particularly strong, with ~$60B in circulation and ~44mm unique addresses holding. In short, global access to the US dollar has turned out to be a killer use case for crypto.

“If people are looking in and only seeing the monkey gifs, that’s not crypto’s fault.” – Scott Alexander, Why I'm Less Than Infinitely Hostile To Cryptocurrency

Crypto as a competitive edge

In the aforementioned examples, crypto as a technology is the product. But there’s also an entire ecosystem of applications and use cases where crypto is simply the rails, enabling a better user experience than what might have existed before. One such breakout application is Polymarket, the world’s largest prediction market. Polymarket is uniquely enabled by the crypto infrastructure on which it is built. There are many obvious and non-obvious reasons crypto is a competitive advantage for an application like this:

Global accessibility. It’s a huge liquidity — and accuracy — problem if the market isn’t global.

Chargeback risk. How can people bet $100k with a credit card? If you lose the bet, would you just charge it back? This risk is massive for non-crypto betting sites, which is why they’ve historically charged exorbitant fees. Polymarket has zero fees at the moment.

Complex coordination. For prediction markets that operate cross-border sans crypto, there’s a massive coordination challenge between banks, regulatory jurisdictions, and foreign exchange service providers. In addition to imposing extra costs on the users, this makes these types of prediction market platforms slow, painful, and difficult to grow.

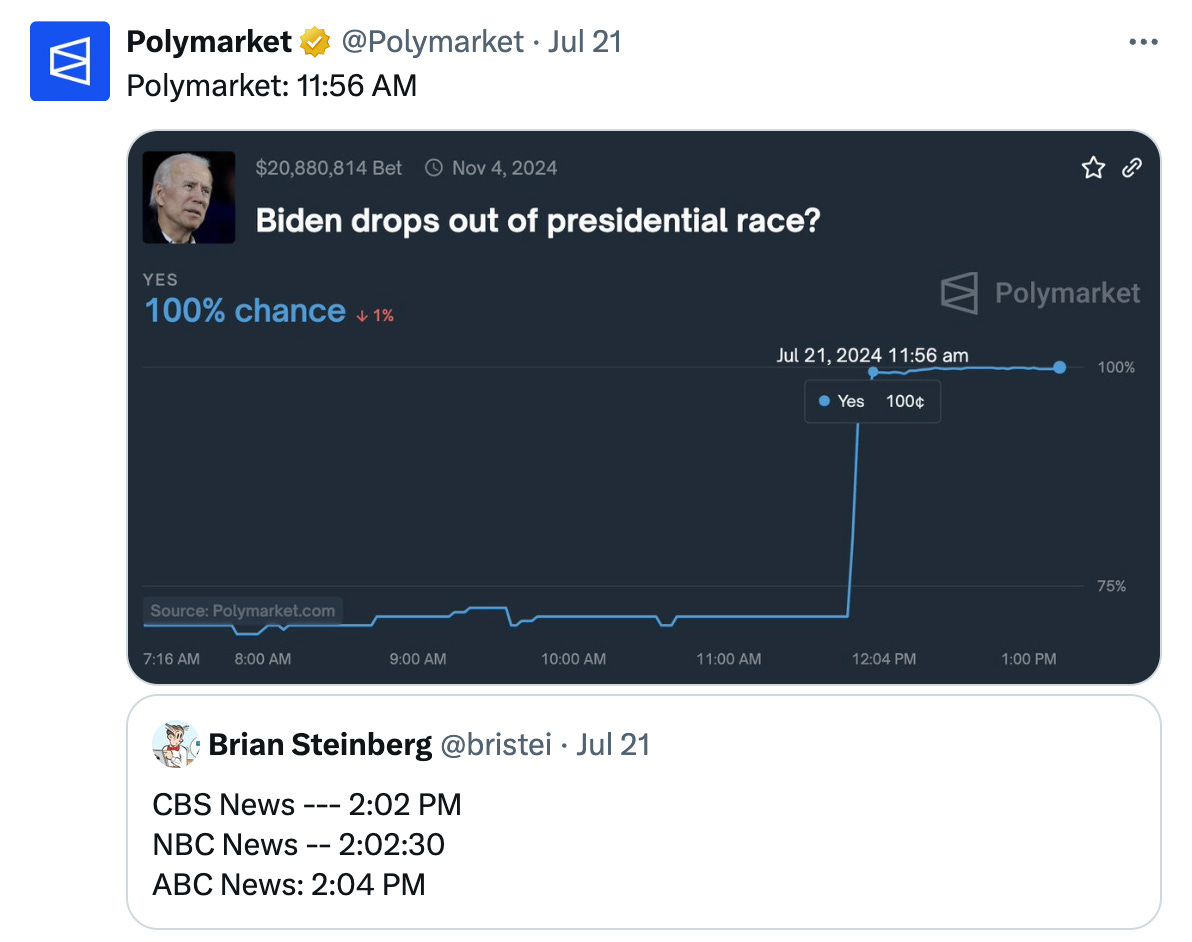

Polymarket is crypto’s poster child because it’s a strong and nascent example of how crypto can unlock use cases that just didn’t work at scale before. Polymarket largely 1) has been faster than traditional news sources and 2) is moving towards a new form of media altogether. This new form of media serves as a source of truth, a peer-to-peer social platform, and engagement mechanism that incentivizes correctness (or at least as close as you can be to correct, given the information available).

We can even see Polymarket embeddings that update in real time right here on Substack (Exhibit A):

These small wins accumulate and slowly bring crypto more and more into the mainstream.

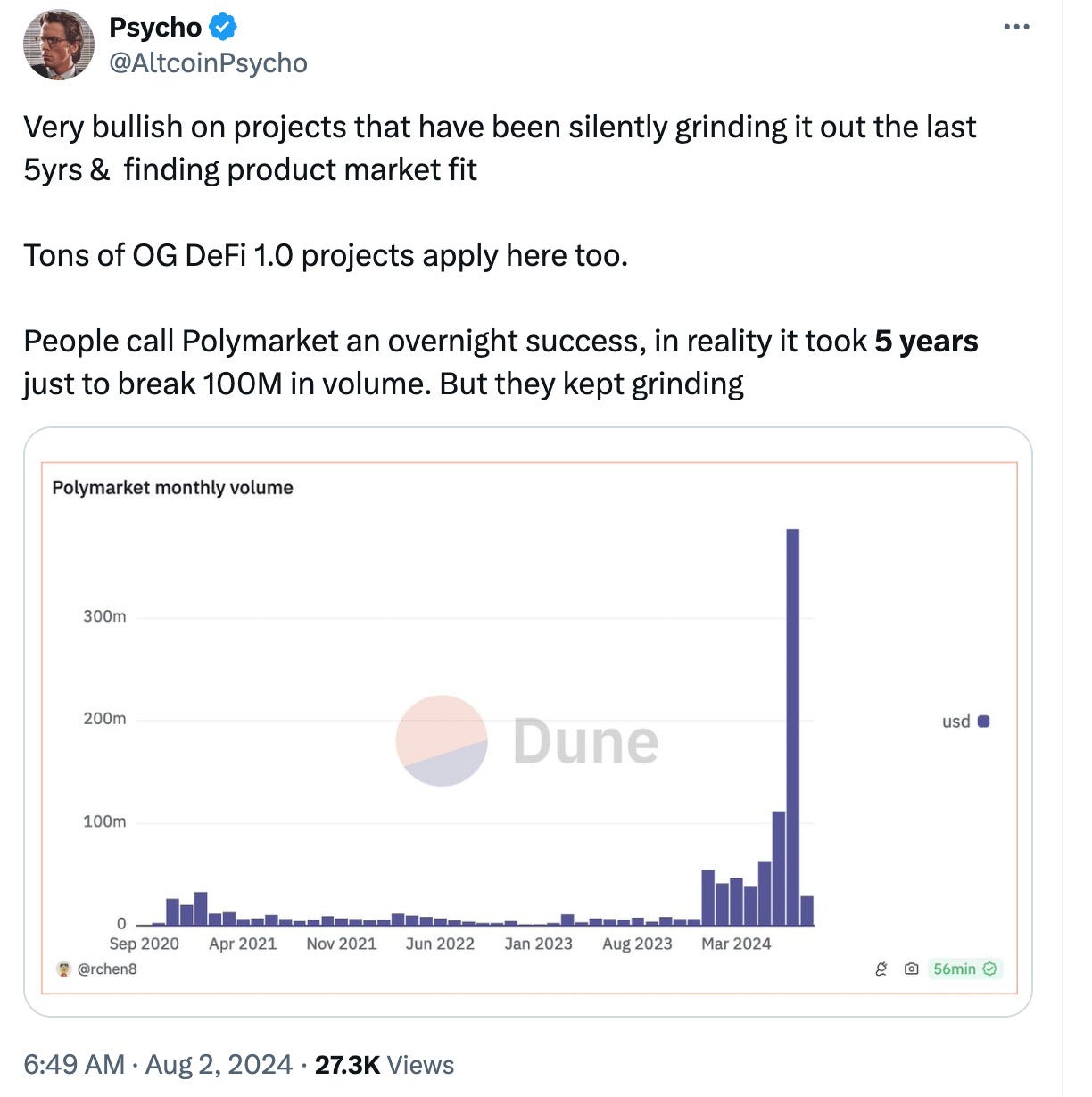

A final note on Polymarket is how long the team has been working on the same vision. Their volumes were low and flat for nearly five years while they relentlessly kept at it — and even when the company nearly died from a $1.4mm penalty charge from the CFTC, they didn’t waver. Crypto’s always had an inherent bias towards the Current Thing™ but people often don’t realize how much time (and work) go into the ultimate “overnight” successes.

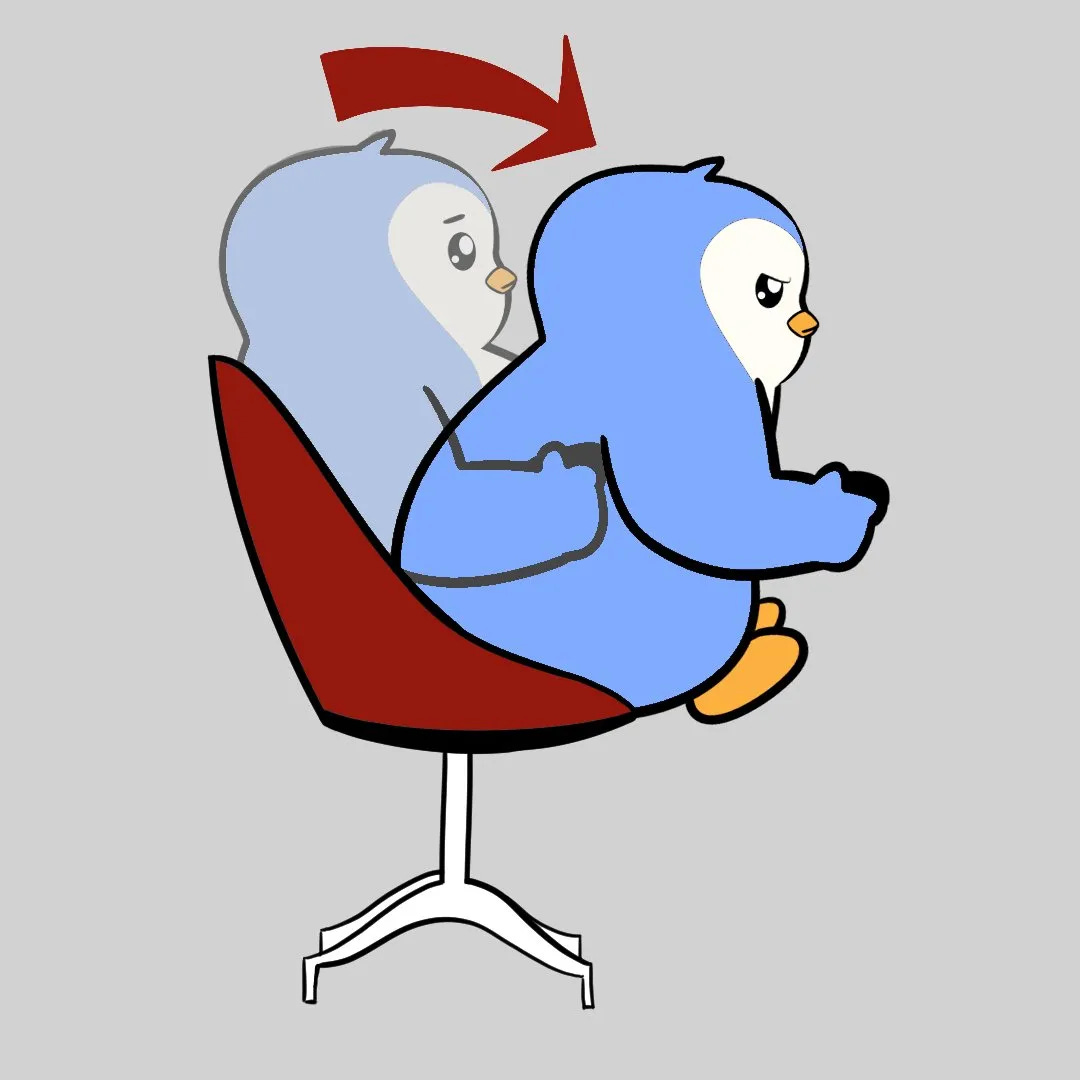

Another company reaching far beyond crypto natives is Pudgy Penguins, whose products are now sold in Target, Walmart, and Walgreens around the United States (with over a million toys sold so far). They’re using their distribution as a way to onboard the masses to crypto; rather than a “build it and they will come” approach, Pudgy is aggressively shipping for their existing user base. Specifically, they’re building out an easy-to-use Layer 2, a game with blockchain-based elements, and even a show — all centered around their lovable brand (which started as just an NFT collection). It’s worth noting that Pudgy worked first to own their own distribution before building lower-level infrastructure into their stack. To date, most other L2s have done the opposite: build the tech and then attempt to bootstrap their community and entice applications to build within their ecosystem.

Pudgy has come up with creative ways to onboard users: for instance, each physical Pudgy toy comes with a QR code that can be redeemed in the Pudgy World game (Webkinz style). By gently introducing users to crypto — and making sure they have fun along the way — they’re more likely to 1) stay engaged and 2) potentially explore crypto more deeply.

Bridging the gap for apps

One company powering a number of projects in the consumer app space with a critical piece of infrastructure is Bridge. They’re working on stablecoin APIs, specifically issuance and orchestration — a company-sized problem that projects had to own in-house before Bridge modularized it. Bridge has shown that doing one (important) thing well is a solid route to take in crypto, and they’ve brought an impressive list of customers on board because of it. What seems like a simple API is actually quite complex on the backend: Bridge handles all of the KYC and compliance on their side, while businesses just need to integrate with them to instantly convert between fiat and stables (or different forms of stables altogether). Even though stablecoins are a core use case in crypto, it’s been difficult to find solutions that on-and-off-ramp quickly and compliantly. Plus, there are many stablecoins out there and each platform often favors one. Bridge solves this in a flexible and easy-to-use way.

YOU get a wallet! YOU get a wallet!

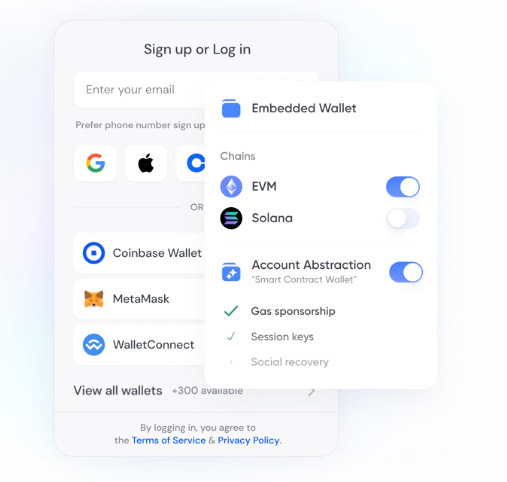

A common complaint in crypto (especially among new entrants) is wallets — which one to choose, how to pick one that connects with the most dapps, and if there are alternatives. A number of providers — Dynamic, Privy, Capsule, and Coinbase WaaS, to name a few — are fixing this problem for both crypto applications and their users by allowing individuals to move onchain without needed to jump through the hoops of downloading a third party wallet application or custodying a seed phrase. Constantly fixing integrations, managing updates, and adding new wallets when they launch (to make sure TAM isn’t limited) is a problem that consumes critical engineering resources on the company side. On the user side, the pain is obvious: without these embedded wallets, a user may not have a supported wallet (or, if they’re new to crypto, they may not have a wallet at all). Streamlining the crypto onboarding flow for new users is a crucial part of enabling mass adoption. These companies — many founded just within the last few years — are all playing a key role.

Embracing unfamiliarity

All this to say, we still have work to do as an industry — but that doesn’t diminish what we’ve achieved so far. Ultimately, if you believe the financial system should be fast, global, low-fee, accessible, and in service of the people, crypto is the only end state.

As a reminder, every new category has gone through growing pains — or often outright opposition — as it matured. When the printing press was originally introduced, monks and religious authorities opposed it because it lessened their control over information. Printing was even outright banned by Islamic authorities. One Swiss scholar, Conrad Gessner, “demanded that those in power in European countries enforce a law regulating the sales and distribution of books. He felt ordinary people should not have access to so many books.” In the late fifteenth century, Italian writer Filippo di Strata wrote, “The pen is a virgin, but the printing press is a whore.”

If the printing press is a whore, then I’m not sure the public’s description of crypto would be fit to print. But we’ll gladly take the blow in honor of progress. To be okay with unfamiliarity is to know that new technologies often look “weird” at the start.

We also acknowledge that the vast majority of experiments in crypto probably won’t pan out. But if you’re still making that argument, then you fundamentally misunderstand how breakout technologies evolve. This is not new. The maturation of the Internet required us to also say goodbye to in-house server farms, web rings, and Sony’s AIBO robot dog. This is a natural and healthy evolution as people experiment with new technology. The “power law” of successful products is quite literally what investors underwrite when entering these spaces.

Infrastructure makes way for apps

Many of the breakout applications this cycle are enabled by new infrastructure that quite literally didn’t exist last cycle. Yes, there is seemingly more infrastructure than applications, but applications can’t really exist — or scale — without robust underlying frameworks. And because much of this is finally ready, innovation on the app side is accelerating.

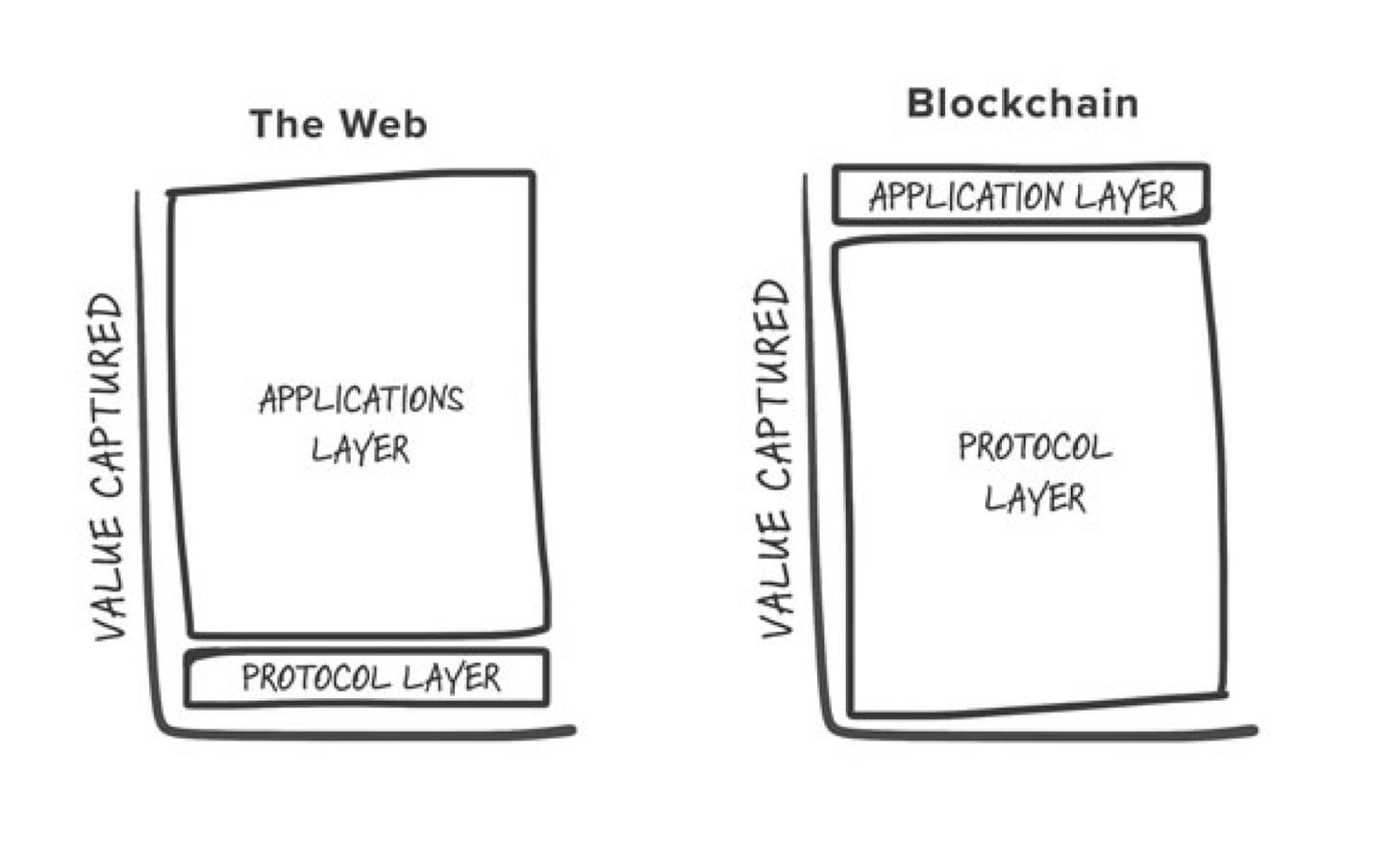

Joel Monegro noted famously in 2016 the concept of “fat protocols,” where in blockchain networks, most value accrued to the protocol rather than the application layer:

The modularization of the protocol layer, in our opinions, has compressed the share of “protocol layer” value capture in order to leave more wiggle room for apps. This way, apps are able to take modular components of the protocol layer, mix-and-match to their needs, and ultimately generate a better experience for their users (and one that’s more profitable as well). Users are now essentially paying applications via frontends that are increasingly abstracting away the protocol layer.

Interestingly, as a result of infrastructure modularization, many problems that Ethereum application developers face today often have less to do with tech and more to do with culture. For those builders, the ecosystem on which they choose to build is critical for their brand, community, and longevity. Sometimes, these apps become known as “the project building on [insert your favorite L2 here]” which can diminish the value of their own product and brand if the L2 doesn’t sustain. Whereas building on Solana is uniform in that everyone is by-default building of the same singular platform, Ethereum poses a critical question for developers: where should I build? Since most chain abstraction protocols aren’t ready, it’s also not really an option yet to “deploy everywhere” either. And when the ecosystem becomes more important than the application itself, it can create a parasitic relationship between the two, with the application and ecosystem both fighting for the same limited attention.

It’s possible that what started this in the first place is the fact that Ethereum did effectively zero marketing, which forced the L2s to create their own brand and style. This credibly neutral approach allowed for a rich and diverse L2 ecosystem, but also of course led to fragmentation. Vitalik highlighted this in a recent post, likening L2s to cultural extensions of Ethereum itself: “for a subculture, a layer 2 is the ultimate playing field for action.” These subcultures may actually be the optimal breeding grounds for emerging applications: users are bought in, communities are tight-knit, and builders are prolific. Further, the culture of the underlying L2 can lend itself to its applications to strengthen and augment their cultures. And of course, from an infrastructure standpoint, many L2s on Ethereum are maturing such that many more applications are made possible to exist and scale.

Closing thoughts

We’ve seen enough cycles at this point to know that infrastructure begets apps which beget infrastructure, and the vicious cycle continues. The emergent technologies we love to complain about are the very products enabling low-fee chains, better distribution, and higher quality UX, all ultimately driving adoption. We still have work to do, but it’s worth recognizing all we’ve been able to achieve in spite of the FTX et al collapses, regulatory headwinds, and extreme market volatility. Our industry is still small and early enough that the work we do should be positive-sum. It’s time to be authentically ambitious again. Like we said… good things take time.

Thank you to Joey Krug and John Coogan for their thoughts and feedback on this piece.

Great article. There is a lot of good stuff happening. It is the uncertainty of especially US politics / regulation (need for bipartisan support for innovation) and the perception of it just being a speculative asset class that is hitting the market over and over again and now it is Telegram. Keep building for the future.

great post as always! Just wanted to point out that the screenshot about Polymarket being earlier than the news is misleading. Polymarket was using a diff timezone, not sure which one though.