Finance, Fairer

Sharing our investment in Jia, which turns crypto liquidity into working capital for small businesses in every corner of the world.

“I think a lot of Westerners want to think of developing-world uses as a boring sideshow, and highlight Westerners trading monkey gifs as the only part of crypto worth talking about. But about 66% of crypto users live in the developing world. More people own cryptocurrency in Africa than in North America… If nothing’s wrong with your country’s financial or political system, then you don’t need crypto.” — Scott Alexander, Why I’m Less Than Infinitely Hostile To Cryptocurrency

Originally published on the TCG Crypto Mirror blog.

Micro, small, and medium enterprises (MSMEs) account for 9 out of every 10 businesses, half of global GDP, and two-thirds of jobs worldwide.1 And yet, there is an estimated $5 trillion credit gap for MSMEs across emerging markets, according to the IFC’s recent analysis by the SME Finance Forum.

At TCG, we believe crypto offers unique ways to address these challenges. In this piece, we’ll outline the emerging market credit gap and the pain points that come with existing small business lending practices in these areas. We’ll introduce Jia, which we believe offers a differentiated solution by bringing blockchain-based lending to small businesses, rewarding borrowers who repay with ownership. Lastly, we’ll share some macro and market observations that make this opportunity particularly exciting to us. We are thrilled to partner with Jia as lead investors in their pre-seed round. Read on for our shared vision for the future:

Understanding the emerging market credit gap

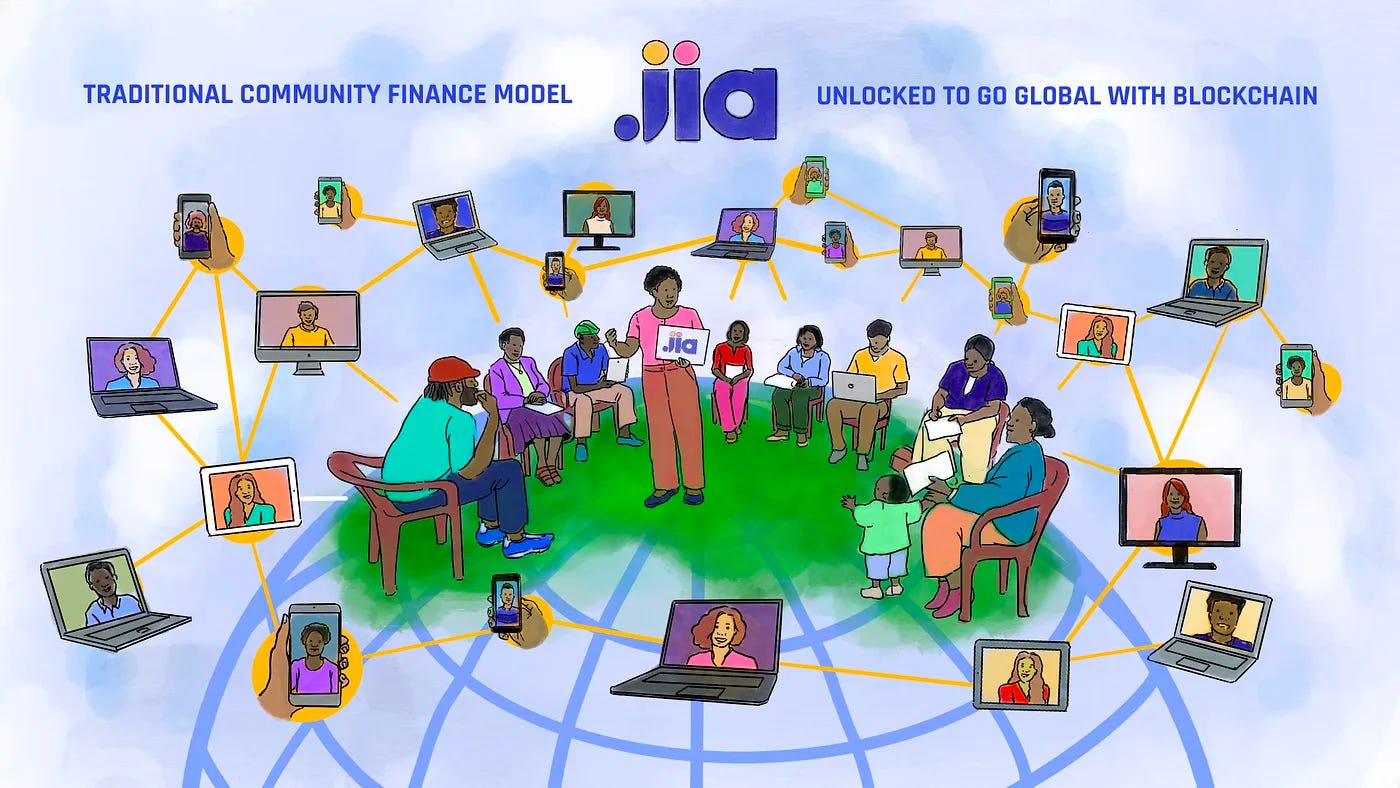

Small businesses in developing markets are commonly overlooked by traditional financial institutions due to high collateral requirements, lengthy documentation processes, and a lack of credit history for many small businesses.2 With limited access to reasonably priced upfront capital, many MSMEs instead rely on informal lenders for financing to run their businesses. This often takes the form of communal finance — in emerging markets, many individuals are members of local savings-and-credit organizations that come together to pool cash & lend on a lottery system.

These groups are known as SACCOs and chamas in East Africa; tandas, cundinas, and juntas in Latin America; paluwagan in the Philippines, arisan in Indonesia and chit fund in India, to name a few examples. They have existed for generations and are built on a fundamental requirement of trust. Importantly, members of these groups are owners as well as customers, contributing to the community via interest revenue from the value they create as businesses.

These communal finance groups work quite well at a local level, but the model breaks beyond that. Many rely on analog processes and often have a single manager running the entire operation. Additionally, a high trust coefficient is achievable at a local level, but difficult at scale. As a result, small businesses in these ecosystems are left with limited access to capital, with the ceiling of opportunity no higher than their immediate networks.

Startups across both web2 and web3 have worked to fill this gap, but suffer from two key challenges. The first is low customer loyalty, largely because lenders treat borrowers in a transactional way. Their incentives are to maximize origination and repeat rate (borrower == customer), squeezing as much value out of borrowers as they can. The second challenge is high costs, leading to high interest rates for borrowers. The cost of capital for emerging market MSME lending is quite high, as central banks typically lend only to large commercial banks and microfinance banks at high rates (due to perceived risk).

Within crypto specifically, most lending protocols require ~150% collateralized crypto assets, which is an almost impossibly high barrier for MSMEs in emerging markets. And while undercollateralized lending protocols like Goldfinch, Credix, and MoHash have emerged more recently, many operate more as alternative debt facility providers to fintech lenders, not directly serving small businesses on the ground in these areas.

“In my understanding, most [DeFi] founders have pivoted towards building products for institutions. Why? Because you can build with scrappy UX, focus on a handful of customers and claim to have billions in TVL… It made commercial sense. The vast majority of the volume came from desktop users. On the other side, exchanges see close to 90% of their userbase coming through mobile apps. At the crux of building on desktop vs mobile is this tussle between volume of capital and human mindshare.” — Joel John, On building mobile first

You’ve probably guessed by now the question we can ask from here: How do we take the savings-and-credit organizations that work so well on a local level and combine them with the scalability, efficiency, and ownership offered by decentralized finance?

Introducing Jia

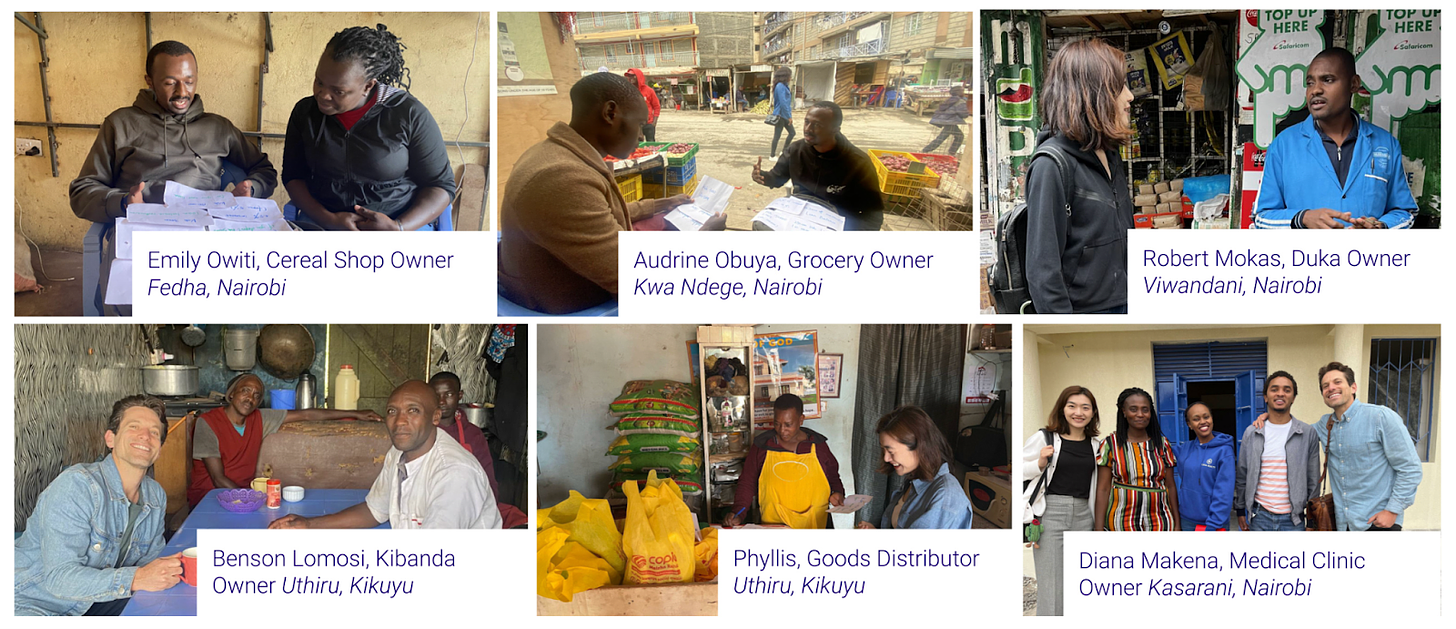

Enter Jia, which provides blockchain-based loans to small businesses and then rewards borrowers who repay with ownership, enabling them to create wealth for themselves and their communities.3 Jia is led by a group of global experts in credit, fintech, and consumer products. Co-founders Zach Marks and Cheng Cheng come from the early team at Tala, a pioneer of the fintech lending industry, where they helped to launch the world’s first mobile microcredit app and grew Tala’s user base from ~6,000 in 2016 to over 6M borrowers over the next six years.

We believe Jia is a global solution for a global problem. Latin America has seen soaring crypto adoption as a result of high interest rates and low trust in banks. West Africa has a strong tech ecosystem, hungry for credit and stablecoin products. East Africa is a frontier for fintech innovation with a friendly regulatory environment. South Asia has the highest proportion of financially constrained microenterprises. And East and Southeast Asia have the highest MSME credit gap by dollar amount of any region in the world, with booming crypto adoption from people eager for solutions. When it comes to the global regulatory landscape, every market is unique, but the vision remains the same: democratize the ability to transact and build equity, no matter who you are.

Jia reaches borrowers through a simple mobile lending app that integrates with small businesses’ existing workflows. After a short onboarding and sign-up process, borrowers submit a loan application (KYC, loan request information and business document upload), which is standard across markets and similar to borrowers’ experiences with other small ticket personal loans. On the backend, Jia employs an automated, data-based credit scoring model to underwrite the borrower. When it comes to loan disbursement and repayment, borrowers can choose how they’d like to handle their loan. Today, most have it disbursed in fiat to their local mobile money wallet or bank account, but an increasing number are experimenting with keeping their funds in a crypto wallet that Jia helps them open. For the borrowers who choose fiat, Jia handles on/off-ramps, helping them access their loan easily while simultaneously working to build an on-chain credit history for them.

All of this is underpinned by the Jia token, which introduces an embedded incentive model and makes borrowers feel like owners, not just customers. For example, small business owners can earn Jia’s native token by taking and repaying loans, depositing savings into stablecoins, and referring friends to join the community. As borrowers accumulate Jia tokens, they can leverage it as collateral to get their loan faster and with better terms (cheaper interest rates, etc.). To incentivize community support and word of mouth, borrowers can also earn Jia rewards by successfully bringing members of their business networks and other local groups into the ecosystem.

The Jia token will likely be the first crypto asset that many of these borrowers own. By building trust with borrowers through this initial touchpoint, Jia has the opportunity to more seamlessly onboard them to other crypto use cases, like holding their money in a US dollar stablecoin, which many borrowers have already requested.

An important note here is that consumers in emerging markets are often faster at adopting new technologies than individuals in more developed areas. A great example of this is MPesa, a mobile money wallet launched in 2007. MPesa in Kenya had far earlier and broader adoption than any mobile financial services product in the United States. Today, MPesa is responsible for transacting around 60% of Kenya’s GDP. Consumers in emerging markets are hungry for new solutions and are willing to try them.

On the other side of this are the individuals who act as liquidity providers for the Jia network. With Jia, investors can access diversified and sustainable yields backed by real-world value creation and assets. For retail and institutional investors alike, Jia may be someone’s first touchpoint into expanding financial access in emerging markets. Crypto liquidity pools enable this type of accessibility, allowing anyone to put their capital to work for real-world impact.

Jia is launching its initial pool on the Huma protocol, an income-backed DeFi protocol that enables businesses and individuals around the world to use their income and receivables as collateral to borrow against. You can read Huma’s whitepaper here and learn more about the partnership in this announcement.

Macro & Market Observations

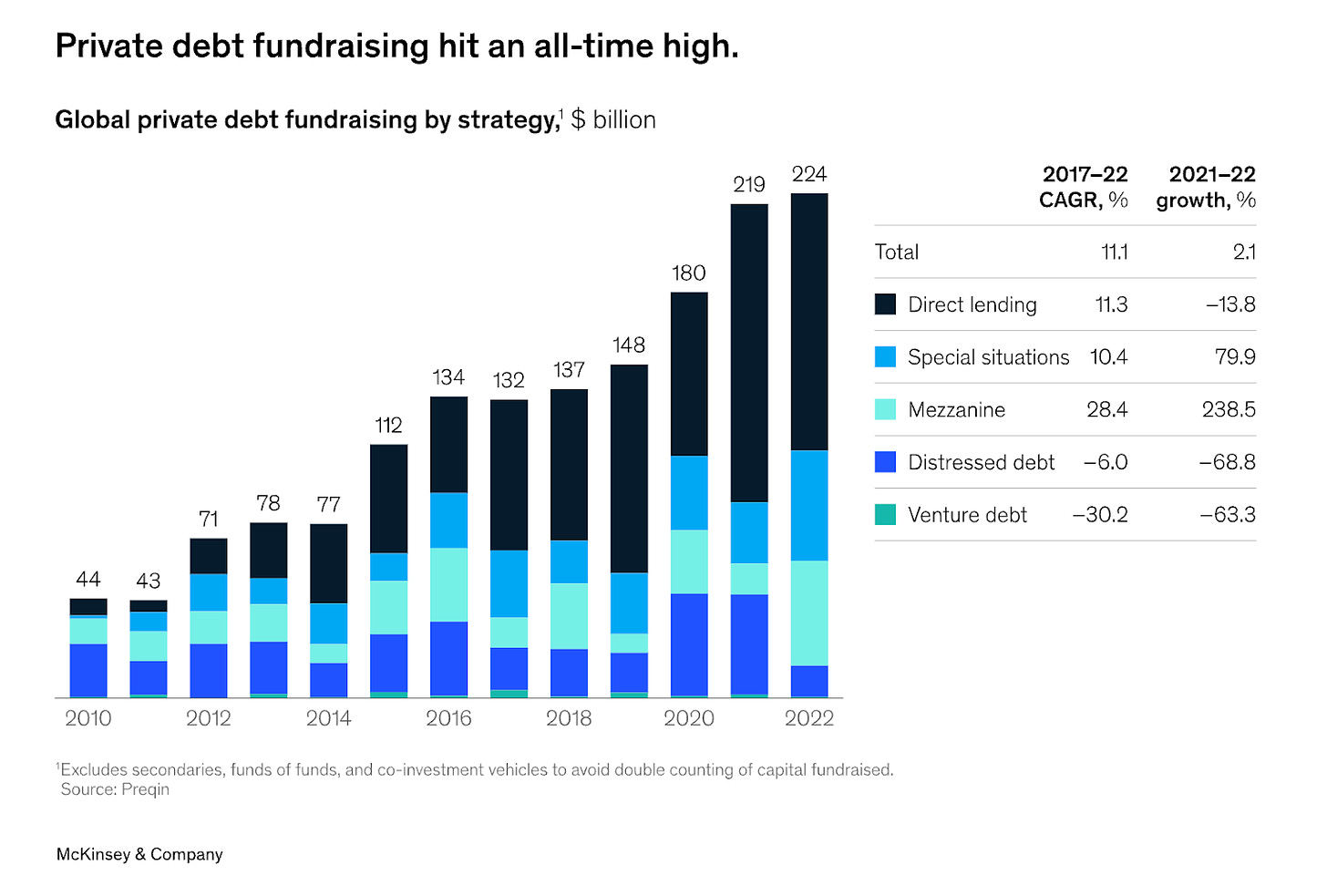

At a macro level, private debt has remained an attractive asset class for investors in times of market volatility, given its reliable yields and diversity of strategies. According to McKinsey’s 2023 Global Private Markets Review, private debt fundraising hit an all-time high in 2022, while other private classes fell considerably.

Emerging markets private credit follows a similar trend, with investment increasing year over year to reach its highest level on record at $10.8 billion in 2022. During periods of inflation and economic uncertainty, the sector seems to perform well in contrast to equities markets.

Bringing this real-world economic activity on-chain benefits both the investor and the borrower. Investors get democratized access to real yield, while borrowers get access to blockchain liquidity, with ownership as a mode to long-term wealth creation for themselves and their communities. The use of blockchain also reduces the large transaction costs (typically passed on to the end borrower) often associated with private credit markets, and enables the creation of on-chain credit histories for borrowers to build reputation over time.4

“Tokenization of financial and real-world assets could be the killer use case driving blockchain’s breakthrough, with tokenization expected to grow by a factor of 80x in private markets and reach up to almost $4 trillion in value by 2030.” — Citi Global Perspectives & Solutions; Money, Tokens, and Games

A number of decentralized applications (dApps) have already tokenized hundreds of millions of dollars worth of real-world assets on-chain. To begin, MakerDAO has arguably made the most progress in terms of raw adoption, with nearly $1B of real-world assets backing the decentralized stablecoin Dai. Introducing real-world assets as collateral enabled MakerDAO to scale the amount of Dai issued into the market, harden its peg stability, and significantly increase protocol revenue (Chainlink).

In December 2022, MakerDAO partnered with Centrifuge (an on-chain ecosystem for structured credit) and BlockTower Capital's credit arm to deploy $220M into real-world assets. This partnership marked the largest on-chain investment in real-world assets to date, as well as the first institutional credit fund to bring their collateralized lending operations on-chain.

Earlier this year, Maple Finance, a blockchain-based credit marketplace, announced plans to expand to tax receivables financing, the protocol’s first step in a new strategy to bring traditional financial investments on-chain. London-based public company AQRU will manage this new liquidity pool, which Maple says can scale up to $100M in size.

Just last month, Franklin Templeton announced the launch of the Franklin OnChain U.S. Government Money Fund, the first U.S.-registered mutual fund to process transactions and record share ownership on a public blockchain.

We believe these are all massive opportunities, as we believe real-world economic activity will only continue to move on-chain. And on the other side of the globe, at a much more micro scale in terms of loan size, Jia shows that this financial innovation does not solely exist for bankers and traditional institutions, but now for billions of people around the world, too.

We are thrilled to partner with the Jia team as they work to bring DeFi lending to the individuals who need it most. We’re honored to work more closely with Zach and Cheng as lead investors in their pre-seed round, along with friends around the table at BlockTower Capital, Draft Ventures, Hashed Emergent, Spice Capital, Awesome People Ventures, and more. This is a big vision and it won’t happen overnight. If you’re interested and would like to get involved, Jia is hiring. To join Jia’s early community and stay updated on progress, you can mint their free commemorative NFT here.

Let’s make finance more fair, together.

Thank you to smac, Zed Tarar, and Ben Roy for their perspectives and feedback on this piece.

TCG Crypto is an investor in Jia. None of the information discussed herein is intended to be, or should be construed as financial advice, or an offer to sell or a solicitation of an offer to buy an interest in any security. The information set forth herein has been obtained or derived from sources believed by the author to be reliable and has been provided solely for informational purposes. Nevertheless, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness. Certain companies referenced herein are included by way of example and not companies in which TCG has invested to date nor companies in which TCG intends to invest.

Source: SME Finance Forum’s MSME Report

Banks in emerging markets are quite conservative in their lending to small businesses. They are slow at adopting new technologies and risk assessment methodologies, and are years from incorporating alternative data-based underwriting (e.g. commerce receipts, point of sale data). As a result, banks are reluctant to extend loans lower than $10,000 to MSMEs. The economics simply don’t work out, so they stick to larger loans for larger, more established businesses where they get better returns.

Jia gets its name from the words for home or family in Chinese (家), heart in Hindi (जिया), and road or path in Swahili (njia).

Blockchains work to “collapse the cost of verification and trust” (Observations on Africa).